Cool Info About How To Find Out My Agi

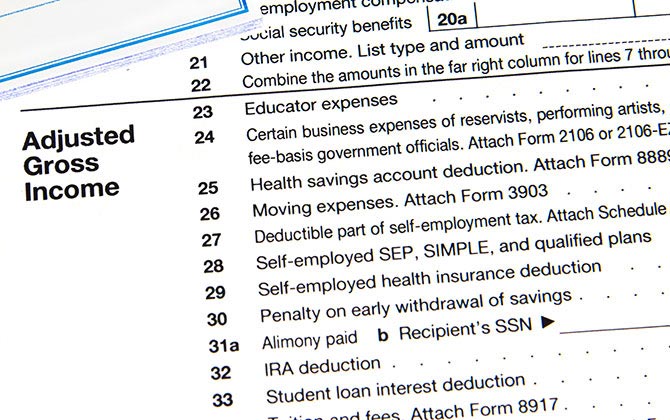

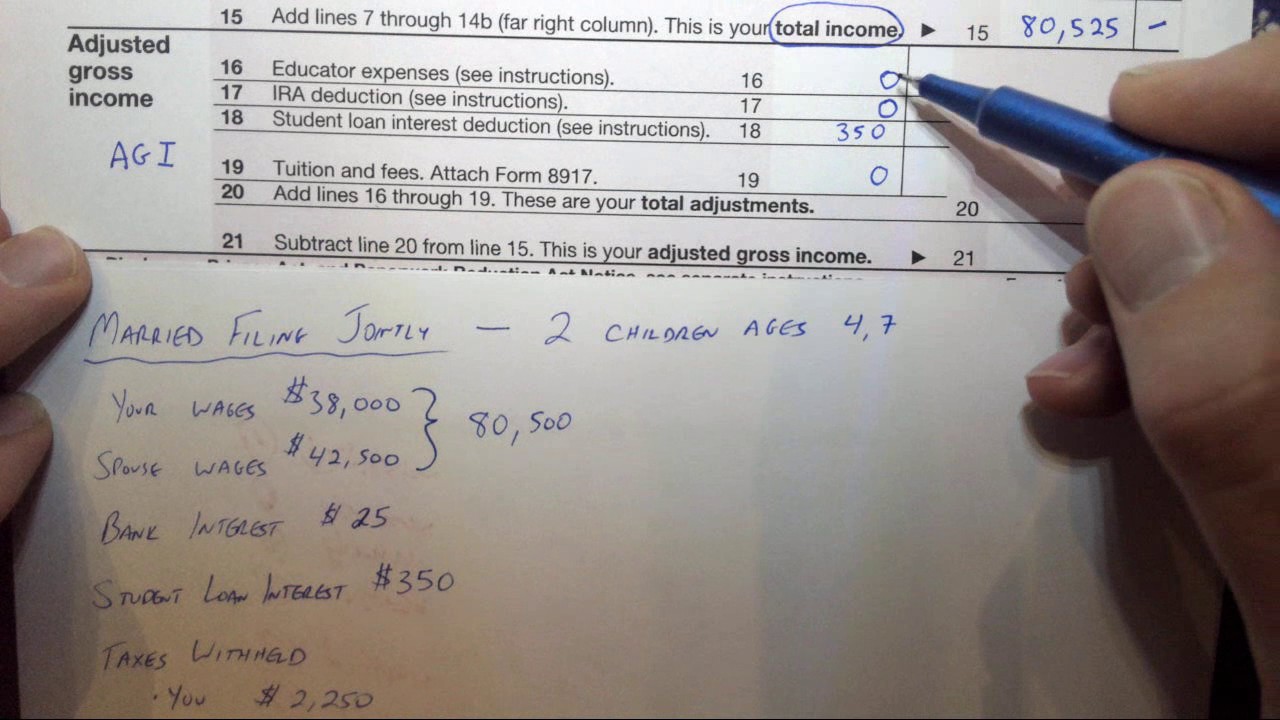

Your agi is on line 21.

How to find out my agi. Use the irs get transcript online tool to immediately view your prior year agi. 1.) determine your gross income. Here’s how to find your agi :

If you don’t have your 2020 return, order a free digital transcript of your return. To retrieve your original agi from your previous year's tax return you may do one of the following: You can get your prior agi from your tax transcript.

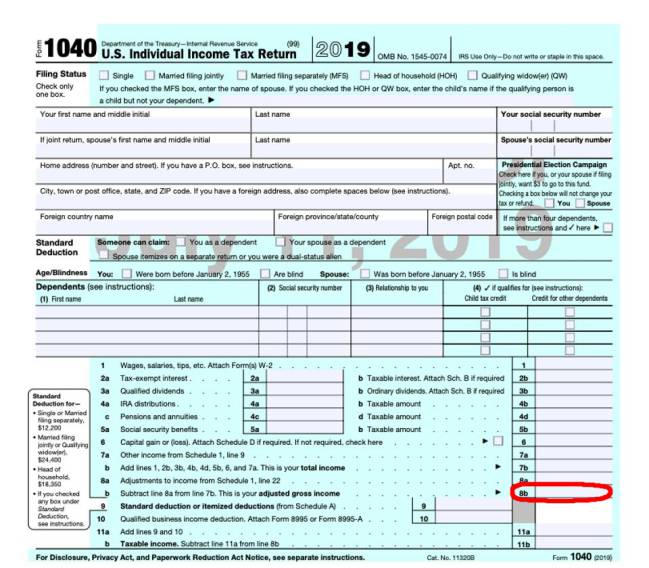

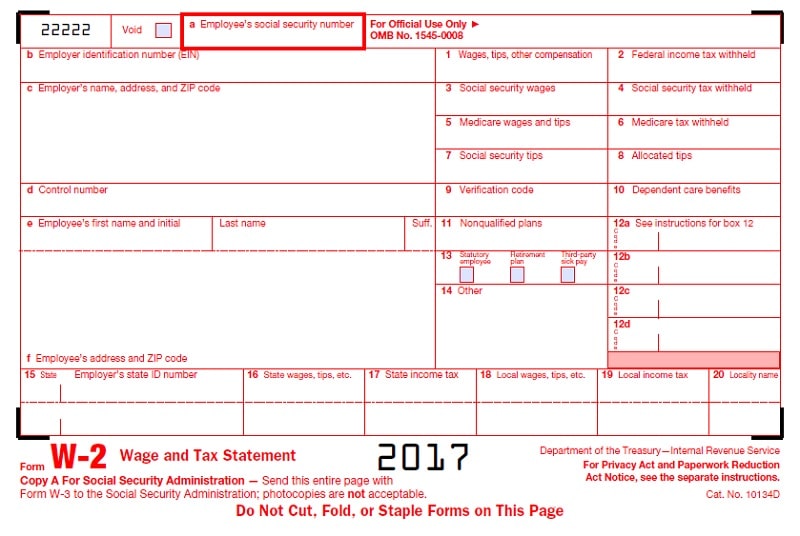

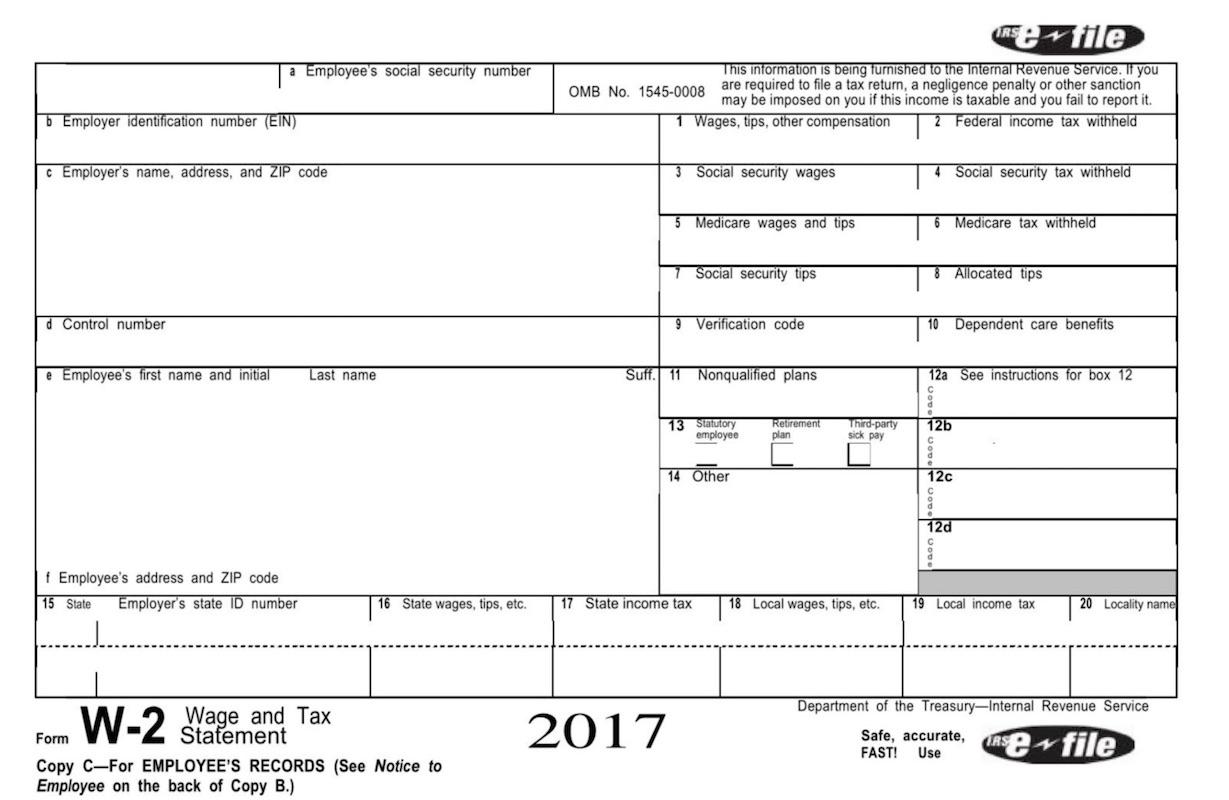

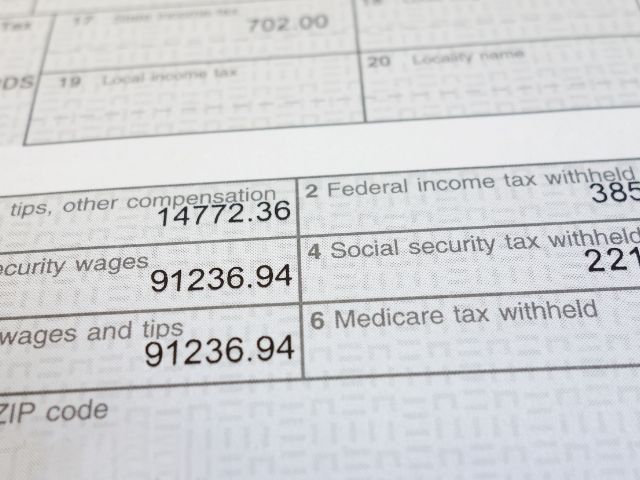

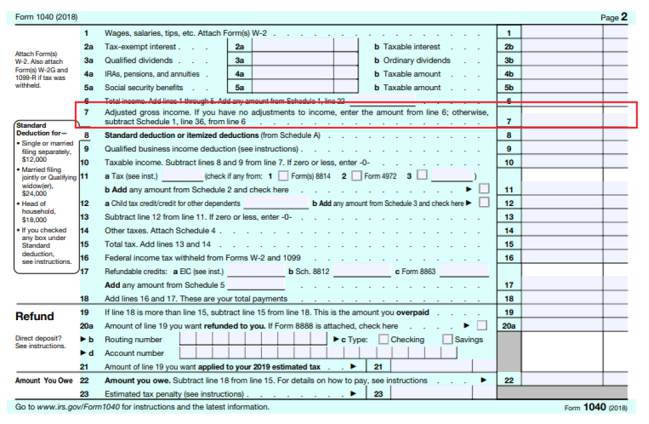

Here's how to calculate your agi. You may request your wage and tax transcript free from the irs (or full tax return at a charge). If you have your 1040 or 1040nr return you filed with the irs for 2020, look on line 11 for your agi.

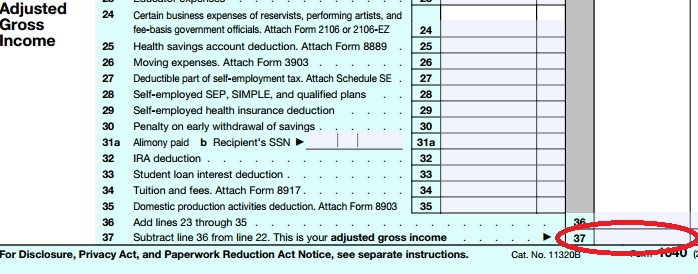

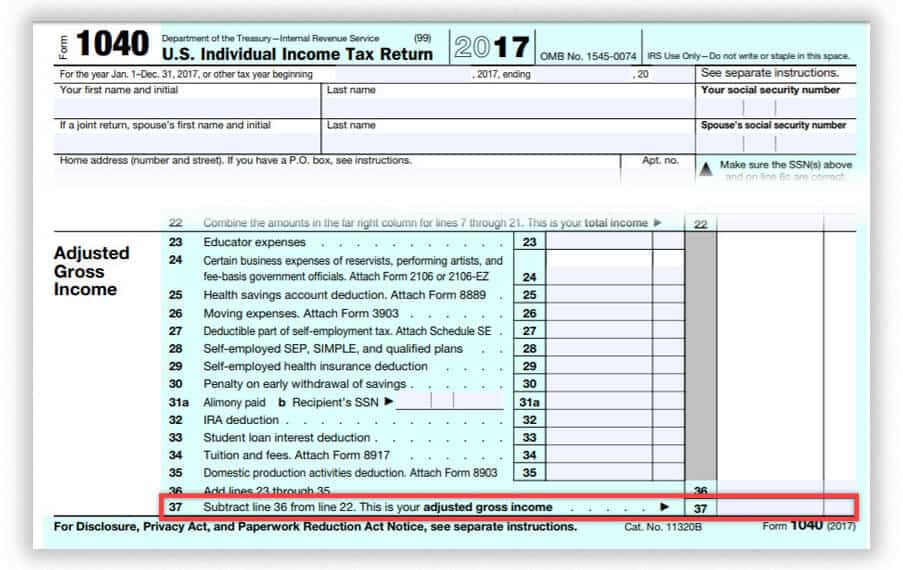

How to calculate adjusted gross income (agi) for tax purposes gather your income statements. You’re agi is on line 37. Your agi is on line 4.

Refer to the 1040 instructions (schedule 1) pdf for more information. Quickest is online, next is. Agi calculator agi cannot exceed total income reported.

Single i know what i made this year. The first step in computing your agi is to determine your income for the. Where does agi appear on tax.